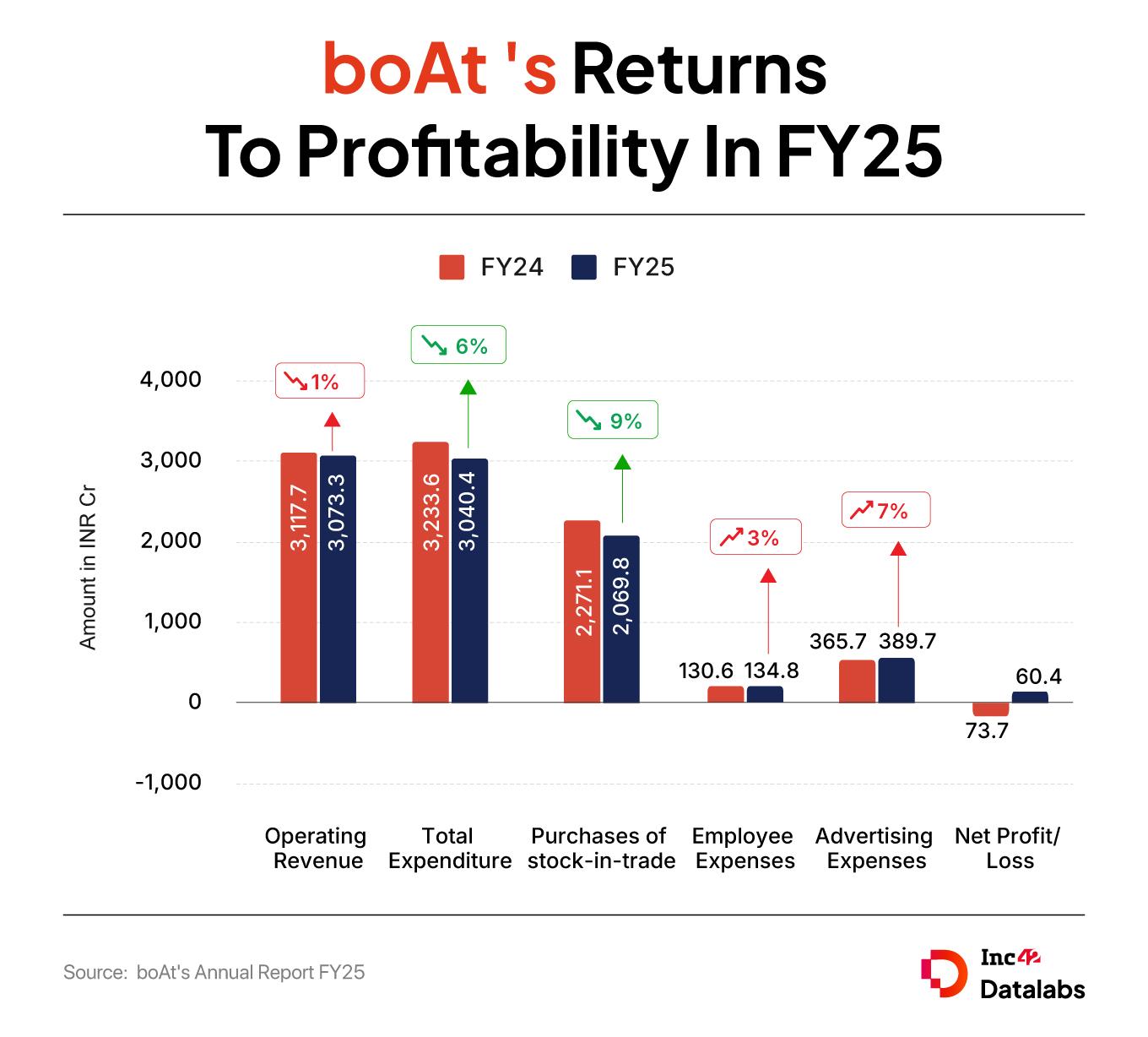

IPO-bound consumer electronics startup boAt swung back to the black in the fiscal year 2024-25 (FY25), reporting a net profit of INR 60.4 Cr as against a loss of INR 73.7 Cr in the previous fiscal.

The Aman Gupta-led startup regained profitability despite seeing a marginal decline in its top line. Its operating revenue stood at INR 3,073.3 Cr in FY25, down over 1% from INR 3,117.7 Cr in FY24.

Inside boAt’s Revenue MachineThe startup earned INR 3,070.4 Cr from the sale of products, while other operating income stood at INR 2.9 Cr. With a revenue of INR 3,050.5 Cr, India was the biggest market for boAt’s products. However, its international sales surged 44% year-on-year (YoY) to INR 20 Cr in the year under review.

In terms of business segments, boAt’s audio products continued to drive its top line. The startup raked in a revenue of INR 2,586 Cr from the sale of audio products, up 5% from INR 2,459.2 Cr Cr in FY24. boAt’s audio product portfolio includes wireless earphones, speakers, and more.

Meanwhile, its revenue from the wearable category, which includes smartwatches, plunged 40% to INR 330.4 Cr during the year under review from INR 550.3 Cr in FY24. This marked the second consecutive year of decline in boAt’s wearable segment sales. In FY24, boAt saw a 44% decline in revenue it earned from this segment.

Notably, boAt started as an audio products company before entering the wearable segment in 2020.

Including other income of INR 24.5 Cr, boAt’s total revenue stood at INR 3,097.8 Cr in FY25 as against INR 3,135.4 Cr in FY24.

Although not part of its revenue, it is pertinent to mention that boAt had an exceptional income of INR 8.6 Cr in FY25 on account of sale of its stake in associate entity Kimirica.

boAt’s subsidiary HOB Ventures Pvt Ltd signed a sale purchase agreement with promoters of beauty and personal care (BPC) brand Kimirica for INR 30 Cr in January 2025.

Later, Kimirica announced raising $15 Mn in August this year. boAt held a 33.3% stake in the BPC startup as of March 31, 2025.

Breaking Down boAt’s ExpensesThe startup managed to turn profitable in FY25 on the back of a 6% decline in its expenses to INR 3,040.4 Cr from INR 3,233.6 Cr in FY24.

Purchases Of Stock-In-Trade: The startup reduced this expense by 9% YoY to INR 2,069.8 Cr. However, changes in inventory for stock in trade zoomed to INR 105.2 Cr, about 3X from INR 39.2 Cr in the previous fiscal.

Employee Benefit Expenses: boAt spent INR 134.8 Cr on employee costs in FY25, a marginal increase from INR 130.6 Cr in the previous fiscal

Ad Expenses: The startup spent INR 389.7 Cr on advertising, an increase of 7% from INR 365.7 Cr in FY24.

boAt’s IPO JourneyboAt’s FY25 report card comes in the run up to its public listing. Thestartup received SEBI’s nod for its confidential draft red herring prospectus (DRHP) yesterday.

While the exact details of the public issue are not clear because of the pre-filing route taken by boAt, it is reported to be looking to raise around INR 2,000 Cr via its public issue.

Earlier this year, it received its board’s approval to raise up to INR 500 Cr from a fresh issue of shares.

This is boAt’s second attempt at a public listing. In 2022, it filed a DRHP for INR 2,000 Cr IPO. The IPO was to comprise a fresh issue of INR 900 Cr and an OFS of INR 1,100 Cr. However, it aborted the public listing plans due to market volatility.

The post IPO-Bound boAt Returns To The Black In FY25, Revenue Dips appeared first on Inc42 Media.

You may also like

GST on 33 cancer drugs, rare disease medicines slashed to 0 from 12 pc: FM Sitharaman

Max Branning makes dramatic EastEnders return in shock Zoe Slater twist

Solanke, Kulusevski, Dragusin - Tottenham injury news and return dates ahead of West Ham

EastEnders fans 'know' who father of Zoe's babies is - and it's not Max

Zoe and Max EastEnders history: How are they linked and what happened between them?