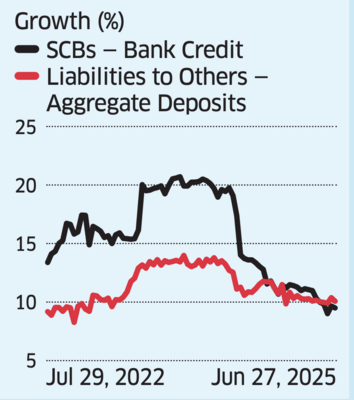

India’s banking system loan growth stood at 9.4% as of June 27, its lowest level since March 2022, after having peaked at 2.74% in the current cycle in December 2023. That said, deposits growth now stands at 10%, exceeding loan demand.

Deposit growth had peaked at 14.04% mid-December 2023. For a greater part of FY25, banks were chasing deposits with special schemes, as deposit accretion failed to match credit demand. Now, despite a reduction in the policy rate of 100 basis points to 5.50%, along with a cut in the cash reserve ratio (CRR) in phases, demand for credit has slowed while deposit growth has gathered pace.

One basis point is a hundredth of a percentage point. The reduction in policy rate has led to transmission of rates to end users, but only partially. The full passthrough will take some more quarters, several bankers said, while announcing the fi rst quarter results. Central bank data showed that about 25-basispoint worth of transmission has taken place on loans while fi xed deposit rates have been reduced in the range of 30-70 basis points since February 2025.

One basis point is a hundredth of a percentage point. The reduction in policy rate has led to transmission of rates to end users, but only partially. The full passthrough will take some more quarters, several bankers said, while announcing the fi rst quarter results. Central bank data showed that about 25-basispoint worth of transmission has taken place on loans while fi xed deposit rates have been reduced in the range of 30-70 basis points since February 2025.

Credit growth may remain weak unless structural reforms in tariff rates and production are taken to boost investments and exports. “There is space for a new producer and exporter of mid-tech goods. India can embrace this opportunity with its abundant labour and wage cost advantage,” said Pranjul Bhandari, chief India economist, HSBC. “But to do this, we believe it needs the right reforms – lower tariff rates on intermediary inputs, more trade deals with other economies, more openness to FDI infl ows, and more ease of doing business reforms across states.”

Deposit growth had peaked at 14.04% mid-December 2023. For a greater part of FY25, banks were chasing deposits with special schemes, as deposit accretion failed to match credit demand. Now, despite a reduction in the policy rate of 100 basis points to 5.50%, along with a cut in the cash reserve ratio (CRR) in phases, demand for credit has slowed while deposit growth has gathered pace.

Credit growth may remain weak unless structural reforms in tariff rates and production are taken to boost investments and exports. “There is space for a new producer and exporter of mid-tech goods. India can embrace this opportunity with its abundant labour and wage cost advantage,” said Pranjul Bhandari, chief India economist, HSBC. “But to do this, we believe it needs the right reforms – lower tariff rates on intermediary inputs, more trade deals with other economies, more openness to FDI infl ows, and more ease of doing business reforms across states.”

You may also like

BREAKING: Paul Gascoigne 'rushed to intensive care after being found collapsed at home'

Bangladesh set to revive caretaker govt system

Mumbai Weather Update: MMR Under Yellow Alert; Lake Levels Cross 82% Amid Ongoing Rainfall

Mumbai News: Silent Protest Against Closure Of Kabutar Khanas Called Off Citing 'Law And Order' Concerns

Videos of Maharashtra minister 'playing rummy' in House sparks row