The proposed reform of the goods and services tax ( GST) framework, which aims to offer significant relief by lowering levies on a large number of items, will be fiscally manageable, officials said.

The Centre is working on a two-slab GST structure to overhaul the eight-year-old indirect tax. “This is proposed to be a sustainable exercise which would be fiscally manageable for both the Centre and states,” a senior government official told ET.

The Centre has sent a proposal to the group of ministers set up by the GST Council on the matter, suggesting that the 12% and 28% slabs be scrapped, leaving only two significant rates — 5% and 18%.

The Centre expects the loss of GST revenue because of lower rates to be made up through greater consumption.

The official said the Centre is an equal partner in GST.

Fin Commission to Assess Impact

“What the Centre earns through taxes is also shared with states through devolution,” the official said. “The Finance Commission is there to look at any impact… but the revenue impact would be manageable.”

It is not Centre versus the states in the council, the official said.

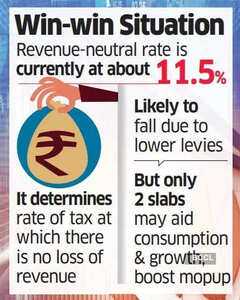

The revenue-neutral rate — the rate of tax at which there is no loss of revenue — is currently at about 11.5% and is likely to fall further.

“Rate reduction mathematically can bring down revenue, but this exercise needs to be seen from its wider and deep economic impact that will lift consumption and growth and in turn revenues,” the official said.

The FY26 budget pegged gross GST revenue at Rs 11.8 lakh crore, a near 11% increase from FY25. Collections were 10.7% up at Rs 8.2 lakh crore in the April-July period from a year earlier. The Centre has budgeted a fiscal deficit of 4.4% of GDP in FY26 compared with 4.8% in FY25.

The Centre is working on a two-slab GST structure to overhaul the eight-year-old indirect tax. “This is proposed to be a sustainable exercise which would be fiscally manageable for both the Centre and states,” a senior government official told ET.

The Centre has sent a proposal to the group of ministers set up by the GST Council on the matter, suggesting that the 12% and 28% slabs be scrapped, leaving only two significant rates — 5% and 18%.

The Centre expects the loss of GST revenue because of lower rates to be made up through greater consumption.

The official said the Centre is an equal partner in GST.

Fin Commission to Assess Impact

“What the Centre earns through taxes is also shared with states through devolution,” the official said. “The Finance Commission is there to look at any impact… but the revenue impact would be manageable.”

It is not Centre versus the states in the council, the official said.

The revenue-neutral rate — the rate of tax at which there is no loss of revenue — is currently at about 11.5% and is likely to fall further.

“Rate reduction mathematically can bring down revenue, but this exercise needs to be seen from its wider and deep economic impact that will lift consumption and growth and in turn revenues,” the official said.

The FY26 budget pegged gross GST revenue at Rs 11.8 lakh crore, a near 11% increase from FY25. Collections were 10.7% up at Rs 8.2 lakh crore in the April-July period from a year earlier. The Centre has budgeted a fiscal deficit of 4.4% of GDP in FY26 compared with 4.8% in FY25.

You may also like

BREAKING: Wacker Quay beauty spot water horror as child in dies in major incident

Plane crash lands on golf course with 'bang' after passing over players

'What I saw in Wrexham loss worried me – Ryan Reynolds has to dig into his pockets again'

Eberechi Eze to Tottenham transfer twist as Crystal Palace offer rejected

'Has Been Asked To Improve Strike-rate': Hesson On Babar's Exclusion From Asia Cup Squad